Frost Pllc Can Be Fun For Anyone

Frost Pllc Can Be Fun For Anyone

Blog Article

Our Frost Pllc PDFs

Table of ContentsThe Only Guide for Frost PllcThe 8-Minute Rule for Frost PllcFrost Pllc Can Be Fun For AnyoneFrost Pllc Can Be Fun For EveryoneThe Ultimate Guide To Frost Pllc

Certified public accountants are among one of the most relied on occupations, and completely reason. Not only do CPAs bring an unparalleled degree of knowledge, experience and education to the procedure of tax obligation preparation and managing your money, they are particularly educated to be independent and unbiased in their work. A CPA will assist you secure your rate of interests, listen to and address your concerns and, equally important, provide you peace of mind.In these critical minutes, a certified public accountant can offer greater than a general accounting professional. They're your relied on consultant, ensuring your company remains monetarily healthy and balanced and lawfully protected. Hiring a neighborhood certified public accountant company can positively influence your service's monetary health and success. Here are 5 crucial benefits. A neighborhood certified public accountant firm can help in reducing your organization's tax obligation problem while guaranteeing conformity with all suitable tax laws.

This development reflects our devotion to making a favorable influence in the lives of our clients. When you function with CMP, you become component of our family members.

Frost Pllc Can Be Fun For Everyone

Jenifer Ogzewalla I've collaborated with CMP for numerous years now, and I have actually actually appreciated their knowledge and performance. When auditing, they work around my schedule, and do all they can to preserve connection of personnel on our audit. This conserves me energy and time, which is indispensable to me. Charlotte Cantwell, Utah Festival Opera & Musical Theatre For much more motivating success tales and responses from company owner, click on this link and see exactly how we have actually made a difference for companies like yours.

Here are some vital concerns to lead your decision: Check if the CPA holds an active permit. This guarantees that they have actually passed the essential tests and fulfill high ethical and expert standards, and it shows that they have the credentials to manage your financial issues sensibly. Validate if the certified public accountant uses solutions that straighten with your service needs.

Small companies have unique financial needs, and a CPA with pertinent experience can supply even more tailored advice. Ask regarding their experience in your industry or with services of your dimension to guarantee they comprehend your certain challenges. Understand exactly how they bill for their solutions. Whether it's hourly, flat-rate, or project-based, knowing this upfront will stay clear of shocks and validate that their services fit within your spending plan.

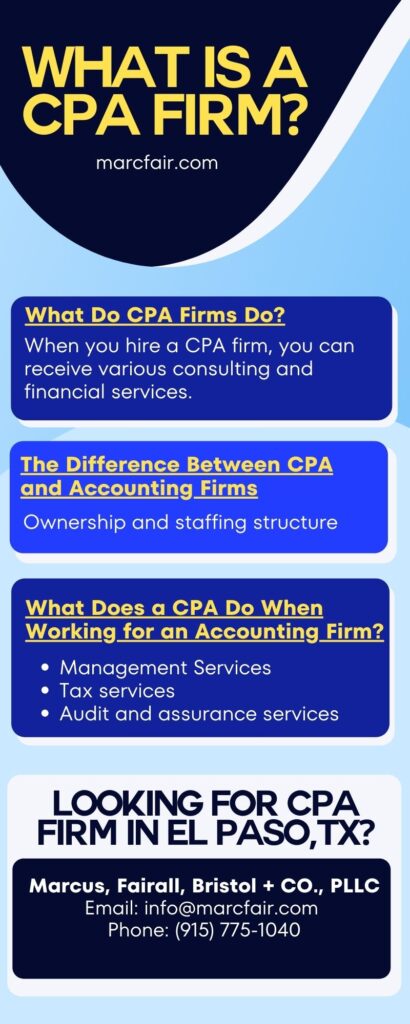

Employing a regional CPA company is even more than simply outsourcing economic tasksit's a clever financial investment in your service's future. CPAs are certified, accounting experts. Certified public accountants might function for themselves or as component of a company, depending on the setup.

documents to a company that specializes in this location, you not just totally free yourself from this lengthy task, yet you additionally free yourself from the threat of making blunders that could cost you economically. You might not be taking advantage of all the tax obligation cost savings and tax reductions available to you. The most critical question to ask is:'When you save, are you putting it where it can grow? '. Numerous companies have actually carried out cost-cutting procedures to lower their total expense, yet they have not put the cash where it can assist business grow. With the assistance of a certified public accountant company, you can make one of the most educated choices and profit-making methods, taking into consideration one of the most current, current tax regulations. Federal government companies in any way levels call for paperwork and compliance.

The Best Guide To Frost Pllc

Tackling this obligation can be an overwhelming task, and doing glitch can cost you both financially and reputationally (Frost PLLC). Full-service certified public accountant companies know with filing needs to guarantee your organization complies with government and state regulations, as well as those of banks, capitalists, and others. You may need to report extra earnings, which may require you to webpage submit an income tax return for the very first time

team you can trust. Get in touch with us for more details about our services. Do you understand the accountancy cycle and the actions involved in making certain correct financial oversight of your business's financial well-being? What is your organization 's lawful framework? Sole proprietorships, C-corps, S corporations and partnerships are taxed in different ways. The more facility your income resources, locations(interstate or global versus regional )and industry, the extra you'll need a CPA. CPAs have more education and go through an extensive qualification procedure, so they set you back greater than a tax obligation preparer or bookkeeper. Typically, local business pay in between$1,000 and $1,500 to employ a CERTIFIED PUBLIC ACCOUNTANT. When margins are limited, this expenditure may beunreachable. The months before tax day, April 15, are the busiest season for CPAs, followed by the months before completion of the year. You might need to wait to get your concerns responded to, and your income tax return can take longer to complete. There is a limited number of Certified public accountants to go around, so you might have a difficult time finding one specifically if you've waited up until the eleventh hour.

CPAs are the" big weapons "of the accountancy sector and generally don't manage daily accounting tasks. You can make sure all your financial resources are existing and that you're in good standing with the IRS. Employing a bookkeeping firm is a noticeable selection for intricate services that can manage a certified tax professional and an exceptional alternative for any tiny business that wishes to minimize the possibilities of being examined and offload the worry and headaches of tax filing. Open up rowThe difference between a certified public accountant and an accountant is merely a lawful distinction this contact form - Frost PLLC. A certified public accountant is an accountant certified in their state of operation. Just a certified public accountant can use attestation solutions, act as a fiduciary to you and offer as a tax lawyer if you encounter an internal revenue service audit. Despite your situation, even the busiest accountants can eliminate the time worry of submitting your taxes on your own. Jennifer Dublino added to this short article. Resource meetings were carried out for a previous version of this article. Audit firms may likewise utilize Certified public accountants, yet they have other types of accounting professionals on staff. Typically, these various other sorts of accountants have specializeds throughout locations where having a CPA certificate isn't required, such as management audit, not-for-profit audit, price accountancy, federal government bookkeeping, or audit. That doesn't make them less qualified, it simply makes them differently qualified. In exchange for these stricter regulations, CPAs have the legal authority to authorize audited economic statements for the purposes of coming close to financiers and protecting financing. While audit business are not bound by these exact same guidelines, they have to still stick to GAAP(Normally Accepted Audit Concepts )finest methods and show high

honest criteria. Consequently, cost-conscious small and mid-sized firms will certainly frequently use a bookkeeping solutions business to not only fulfill their accounting and accounting demands now, yet to scale with them as they expand. Don't allow the viewed reputation of a business full of CPAs sidetrack you. There is a misunderstanding that a CPA company will certainly do a better task because they are legitimately permitted to

carry out more tasks than a bookkeeping business. And when this is the instance, it does not make any kind of sense to pay the costs that a CPA company will certainly bill. Organizations can conserve on costs significantly while still having actually high-quality job done by using a bookkeeping solutions company rather. As an outcome, utilizing an audit solutions business is usually a far better worth than employing a CERTIFIED PUBLIC ACCOUNTANT

Fascination About Frost Pllc

firm to sustain your ongoing economic management initiatives. If you only need interim bookkeeping assistance while you service hiring a full-time accountant, we can assist with that as well! Our audit and money recruiters can help you bring in the best candidate for an internal function. Get in touch with us to discover more today!. They can function together to guarantee that all elements of your monetary strategy are lined up and that your financial investments and tax obligation approaches interact. This can lead to better results and a lot more effective use your resources.: Dealing with a consolidated CPA and financial advisor can conserve costs. By having both professionals working with each other, you can stay clear of duplication of solutions and potentially lower your general prices.

CPAs likewise have expertise in establishing and improving business policies and treatments and assessment of the functional requirements of staffing models. A well-connected Certified public accountant can take advantage of their network to assist the company in different tactical and getting in touch with roles, properly linking the organization to the excellent candidate to satisfy their demands. Following time you're looking to fill up a board seat, consider getting to out to a CPA that can bring value to your company in all the means noted above.

Report this page